OZ

Size: a a a

2020 June 29

E C

Негражданину грузии надо 183 дня будет жить если он ИП ?

Нет ИП может где угодно находиться

EC

Нет ИП может где угодно находиться

То есть похоже на ИП в РФ? Расходы можно наверное любые от имени ИП производить

OZ

E C

То есть похоже на ИП в РФ? Расходы можно наверное любые от имени ИП производить

конечно, там же налог с оборота

DR

ID:0

🇷🇺 Bare Trust по законодательству РФ это КИК?

Анонимная викторина

67%

Да, это КИК

33%

Нет, это не КИК

любой траст кик, тут вопрос в его наполнении и выплатах, а так же схемах контроля

R

удержание всех налоговых платежей в Эстонии возлагается на юрлицо. физикам-нерезам до этого фиолетово

https://www.emta.ee/eng/business-client/income-expenses-supply-profits/taxation-income-non-residents#Ankur1

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

ОТ

R

https://www.emta.ee/eng/business-client/income-expenses-supply-profits/taxation-income-non-residents#Ankur1

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

Товарищ шарит =)

ОТ

Так же ничего связка британских форм (британское ЛП, шотландское ЛП) с грузинским физиком или ИП. (уже в составе британской структуры)

В

R

https://www.emta.ee/eng/business-client/income-expenses-supply-profits/taxation-income-non-residents#Ankur1

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

Прекратите пожалуйста писать свои фантазии

На сайте налоговой ясно сказано -

Income tax is not charged on income derived by a non-resident natural person from work or activities if the non-resident performed his or her duties or provided the services outside Estonia. There is no need to file tax return on income of non-resident that is not taxable in Estonia.

For example, if the Estonian employer pays wages to a non-resident long-distance driver, income tax is not withheld from the payment, as the work is done outside Estonia.

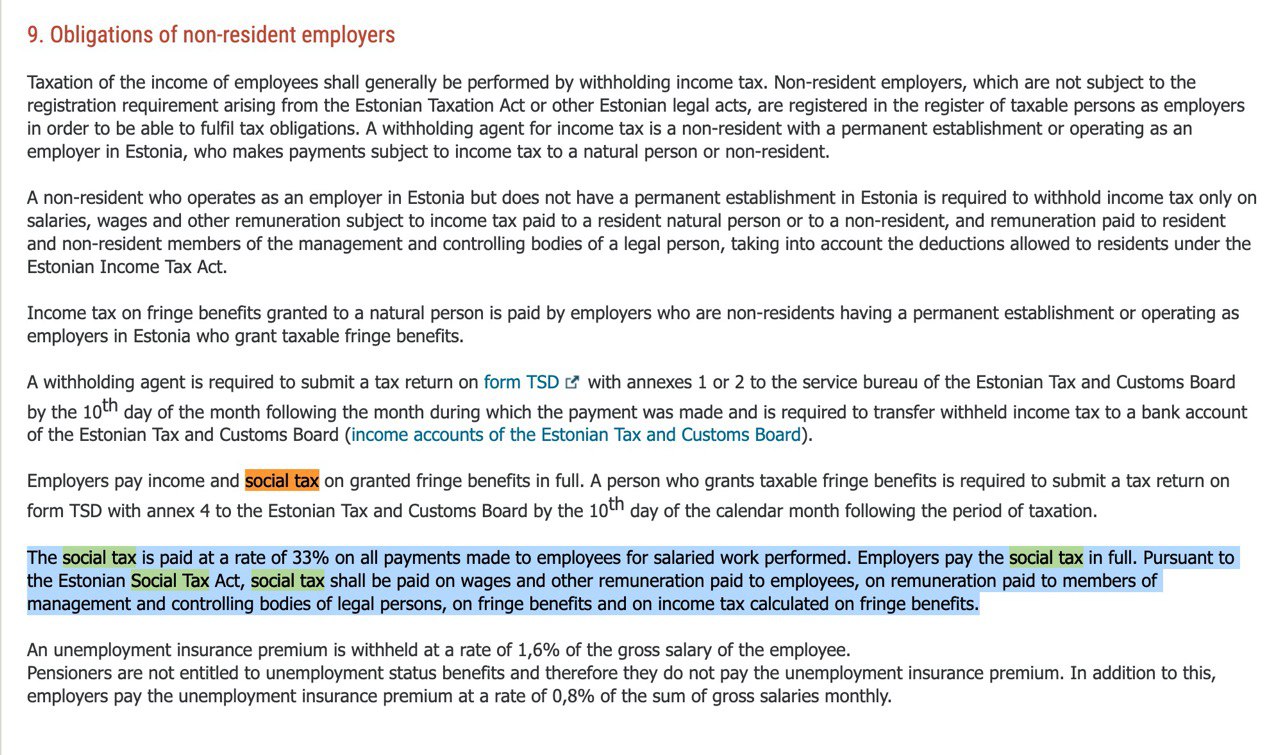

The social tax is paid at a rate of 33% on all payments made to employees for salaried work performed. Employers pay the social tax in full. Pursuant to the Estonian Social Tax Act, social tax shall be paid on wages and other remuneration paid to employees, on remuneration paid to members of management and controlling bodies of legal persons, on fringe benefits and on income tax calculated on fringe benefits.

OZ

The social tax is paid at a rate of 33% on all payments made to employees for salaried work performed. Employers pay the social tax in full. Pursuant to the Estonian Social Tax Act, social tax shall be paid on wages and other remuneration paid to employees, on remuneration paid to members of management and controlling bodies of legal persons, on fringe benefits and on income tax calculated on fringe benefits.

ну так если речь идет о резидентах то да, если о нерезидентах см выше

В

ну так если речь идет о резидентах то да, если о нерезидентах см выше

KА

Это относится к работодателям-нерезидентам. То есть зарубежные компании, которые платят работникам в Эстонии.

EC

А вообще как все работники оформлены в Азии, снг , которые работают на европейские компании представителями/business development? Все по договору услуг?

VC

VC

Пионер принял решение покрыть все, что на счетах у вс за свои

VA

Невероятбл

A

Явно какую-то гарантию получили. Некоторые другие компании также вернули средства с карточного баланса. Пайонир протянул дольше остальных.

VC

Alexander

Явно какую-то гарантию получили. Некоторые другие компании также вернули средства с карточного баланса. Пайонир протянул дольше остальных.

Да, не верится, что покрыли 100% со своих без гарантий что-то вернуть

EG

Да, не верится, что покрыли 100% со своих без гарантий что-то вернуть

Обычно в такой ситуации клиенты успокаиваются и вывод не будет больше 25%

VC

Обычно в такой ситуации клиенты успокаиваются и вывод не будет больше 25%

Стратегически правильное решение, конечно

KR

Коллеги, вечер добрый

Есть готовые компании в ГК со счетом там же? Нужно 4-5 штук

Пиво Шарикову не наливать, платежки просьба не предлагать :)

Есть готовые компании в ГК со счетом там же? Нужно 4-5 штук

Пиво Шарикову не наливать, платежки просьба не предлагать :)